Plus where to find useful research tools and data about major layer 1 blockchains.

In this article, I will show you how to research layer 1 smart contract platforms. What is the point of examining Ethereum, Binance Smart Chain, Avalanche, and other base networks?

In short: It’s not just about determining the investment potential of an L1 blockchain itself. It also analyses the basic potential for layer 2 solutions in the given network.

Let me explain why.

A good layer 1 network is the basis for successful layer 2 solutions

We can view layer 1 blockchains as different nations. They are independent of each other, each of them has its own data, network, consensus mechanism, ecosystem, etc. They can validate and finalize transactions without other networks. The stronger a ‘nation’ is, the better the conditions for all projects developed as layer 2 protocols.

The law of multiplying by zero comes to mind: In some cases, a single critical mistake or deficiency can cause the whole system to collapse. Meaning that the most promising layer 2 crypto project will fail if the underlying L1 blockchain is a piece of junk.

OK.

With the basic understanding in place, let’s get to the meat of this guide and go through the individual steps of researching L1 blockchains.

How-to Research L1 Blockchains step-by-step

To determine the quality of a layer 1 network, you need to assess a couple of key aspects. Let’s look at them one by one.

1. Developer friendliness

This refers to how easy or difficult it is for others to build solutions on top of a given layer 1 network. The following points are of relevance here:

- What is the chain’s programming language? An easy-to-learn programming language (or a blockchain that supports multiple languages) is more likely to attract developers.

- How good is the online documentation and are there a lot of (up-to-date) tutorials available? This makes it easier for developers to learn to build on the chain.

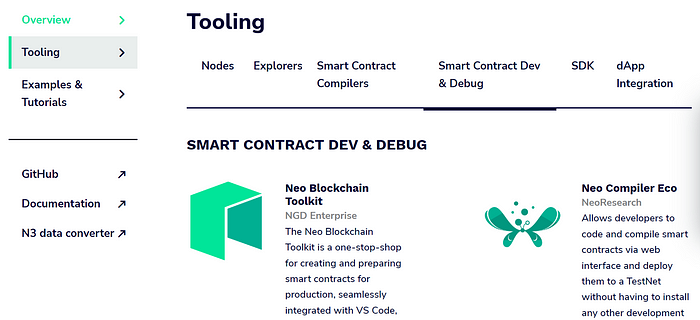

- What tools does the blockchain provide for developers of layer 2 applications? Think of software development kits (SDK), sandboxes, benchmarking tools, block explorers, smart contract compilers, debugging tools, etc.

To figure these things out, go to the L1 network’s website, and read their whitepaper and documentation.

2. Decentralization

Decentralisation is essential for blockchain security and its trustworthiness. What does decentralisation in this context mean?

Ethereum founder Vitalik Buterin differentiates between 3 kinds:

- There is no single point of failure (architectural decentralisation).

- no individual or single organisation controls the whole system (political decentralisation).

- The network can be cut into half and each half functions like an independent unit (logistical decentralisation).

To summarise, you’d want to see a high degree of decentralisation. However, keep in mind, that there is no project that is 100% decentralised.

Moving on.

These are the things you should research to assess how decentralized a layer 1 blockchain is:

- How many nodes are there? The more the better.

- Where are they located? The further they are geographically distributed, the better.

- What’s the share of the hash rate that individual mining pools hold in proof-of-work (PoW) networks?

- How big is the share of coins held by the top wallets in a proof-of-stake (PoS) network?

If you want to understand this topic better, here is an in-depth article I wrote about the decentralization of some of the biggest blockchains such as Bitcoin and Ethereum.

3. Security

Another very important aspect is how immutable a blockchain is. Most of us are not IT security specialists. That’s why we have to rely on developers, contributors, white-hat hackers, and others to make sure the blockchain’s code is free from bugs and risks. However, there are several questions we can try to answer:

- Can the blockchain withstand various attacks such as a 51% attack, Sybil attack, distributed denial of service attack (DDoS), etc.?

- It is also important for us to understand how different consensus algorithms work theoretically and what their advantages and disadvantages are. This in turn can help us to understand what kind of threats or attacks the blockchain could be facing.

By the way, have you already checked out my article about how to research cryptocurrencies? It’s the most extensive guide for free on the net!

4. Active users and daily transactions

You can build the best software ever. But if nobody uses it then it is nothing. That is why it’s important to get an understanding of user activity. These are the stats you should focus on:

- What’s the long-term trend of user numbers? A steady increase in active users is a good sign.

- What can you learn from the number of daily transactions? Again, what you’d want to see here is an increase in daily transactions.

- How many hodlers are there? This plays into the former two stats. While a certain percentage of people just holding the blockchain’s native currency is a good thing you don’t want too many people just hoarding coins without ever using them.

The get this information check out the list of resources I am sharing at the bottom of this article.

5. Transaction fees

Ideally, transaction fees should be affordable for users. Too expensive fees could have a negative impact on the chain’s development. However, it could also reflect how much users are willing to pay for the block space. Premium = more security.

6. DApps and ecosystem

This is a great indicator, because if we view each L1 blockchain as a nation, then the DApps built on them are like the economic sectors in the nation. For a nation to thrive, diversified industries and economic activities are essential. Also, a big and diverse ecosystem attracts investments and new solutions.

Go to dappradar to see the popular DApps for every L1 blockchain. This website also lists the number of users of each DApp.

But DApps are just part of the whole ecosystem. Other aspects include exchanges (centralized and decentralized), and infrastructure such as bridges, oracles, APIs, etc.

7. Developer activity

This information can be found from the project’s Github page. It’s a great source for insights, even if you have zero knowledge about programming. Here you can learn about the following things:

- How many active developers are contributing to the chain?

- How many commits are there per day?

Let’s take Solana as an example:

On the ‘Contributors’ page, you can see the contribution activity over time as well as who are the main contributors and during which time frame they are active.

In the ‘Commits’ and ‘Code frequency’ sections, you can check more details about the number of commits, additions, and deletions every week.

PS: the website Cryptomiso.com also summarizes Github commits information of 300 popular crypto projects.

8. Is the L1 network backed by VCs?

Institutional money is one of the easy to verify key indicators that tell you if a project is good or not. That’s because normally, VCs do their own in-depth research before they invest. However, being backed by a VC does not guarantee a project will be successful. The recent Terra debacle is a reminder of this.

9. Social media activity

To wrap things up, always take some time to check out a network’s social media accounts. Here’s what you can learn from taking a look at their Twitter, Telegram, Discord, etc.

- What are they talking about? Just shilling the project or discussing problems and improvements?

- Do they offer insights into road maps, development progress, etc.?

- It is not a good sign if the official social media accounts have not been updated for some weeks. It could be a sign that the team is running into problems or has abandoned the project.

Summary + Useful links of major L1 blockchains:

It is challenging to find all the information I have listed in this guide. For example, there is no website listing the active addresses of certain projects. Don’t worry too much if some information is too hard to dig up. Just try to gather as much data as possible in order to make a well-founded statement about the status of a project.

Here are some great resources you can use when researching some of the top layer 1 blockchains:

Ethereum:

- https://etherscan.io/charts

- https://messari.io/asset/ethereum/charts

- https://www.ethernodes.org/countries

Solana:

- https://solscan.io/

- https://analytics.solscan.io/public/dashboard/8d888828-baae-47b9-948b-d087e5de1411

- https://solanabeach.io/

- https://explorer.solana.com/

Binance Smart Chain:

Avalanche:

Cardano:

Polkadot:

Fantom:

Algorand:

Cosmos:

I hope you found this guide useful. Let me know in the comments about your thoughts and if you have any additions.

Cheers!For more articles I wrote on how to research crypto projects, please check out my list: https://ren-heinrich.medium.com/list/how-to-research-crypto-projects-5fd393fd0be8